Mississauga Housing Market

The story of residential real estate in the Mississauga/Milton/Oakville region is one seen across Canada as higher mortgage rates are pricing a growing number of buyers out of the market.

And with a ban on foreign purchases of property, the Mississauga buyer market profile has changed greatly. Canadian buyers struggle to find the downpayment and financing and more financial creativity is required.

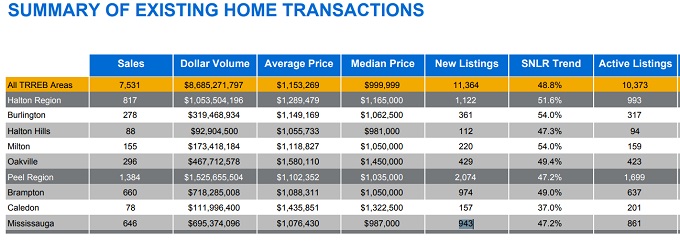

Across the GTA, home sales dipped by 5.2% year over year while prices dropped 7.8%. The poorer performance of the resale housing market speaks of homeowners hanging onto their homes and prices that are out of reach for buyers who can’t get financing. REMAX says the market here is balanced and forecasted sales to grow 12.5% during 2023.

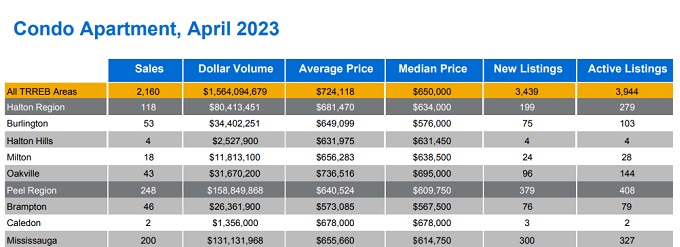

In Mississauga in April, 646 homes were sold at a median price of $987,000. The number of sales of all types grew from 588 in March to 646 in April. There were 943 listings and 861 new listings. Single detached home prices rose substantially to $1,567,031 from $1,195,000 in March. Condo Townhouse median prices meanwhile fell dramatically to $614,750 from $800,000 in March.

In Mississauga, the average listing price to selling price ratio rose 2% in April to 102%.

New listings across the greater Metro Toronto region are down 38.3% and days on market are up a troubling 71.4%. In Mississauga, new listings dropped from in April to 943 units, vs 213 in April. Active listings rose slight from 147 units in March compared to 159 available in April. For buyers, it is a difficult market and an experienced Mississauga Realtor is your best bet.

For home sellers in the Mississauga region, it’s a case of nowhere to go with few homes for sale, high mortgage refinancing or ultrahigh rent prices in Peel Region.

In Milton, west of Mississauga, there were 155 homes sold in April compared to 146 in March while home prices rose from $1,133,210 in March to $1,133,210 in April. In April there were 220 new listings and 159 active listings, compared to March where there were 213 new listings and 147 active listings. LP/SP ratio in Milton rose 1% to 101%. Milton has 1.7 months of inventory while Mississauga now has 3.8 months, up slightly from March.

And in Oakville to the southwest, home sales rose to 296 from 278 sold in March, while home prices rose to $1,118,827 to $1,580,110. Average sales to listing price ratio hit 102%. There were 423 active listings for 2.4 month inventory, and 429 newly listed homes.

Mississauga has undergone a dramatic change in the last 10 years. A gigantic leap in housing prices along with an explosion of new condo developments has created a strong real estate market. It won’t hurt to bookmark your source of homes for sale in Mississauga. and keep persisting with your agent to land your new home. Persistence is the key.

Home and Condo Sales in Mississauga

Sales of all housing types had been on an incline since the drop in 2017. A lack of detached housing amidst strong population growth has pushed many buyers into the more affordable condo apartment market. And now condos and apartments are quickly rising to an unaffordable price level. 2021 will see further price pressure.

The Toronto housing market in 2020 is driven by a strong lack of availability of affordable units, US China trade problems, consumer debt, high taxes, high municipal fees, yet a now favourable CAD USD exchange rate.

Please do Share this Post on Mississauga Real Estate

Need to buy or sell in Mississauga, Oakville and Milton? See Damir Strk with Remax, who has been active in the region for 20+ years. He knows the trends, buyers and sellers and the amazing neighborhoods – find his contact details on his site, and mention that I sent you!

Is it Boomtimes or a Crash Ahead?

For so many years, forecasters have predicted a Toronto Real Estate crash. Some were wishful only hoping that housing prices would fall while others were politically motivated to see markets crash everywhere.

With mortgage rates expected to fall in 2024, the forecast is for a robust growth in Mississauga home prices. Rent prices across the GTA and in Mississauga are very high and renting is not an attractive option for most buyers, even when mortgage rates are high.

The shortage of housing in Oakville and Milton is persistent as these cities are highly sought, yet high quality neighborhoods in Mississauga are no exception.

Forecasting sales volume and housing prices in Toronto or Mississauga is fraught with some tough challenges. Despite the economic uncertainty and the risk of fast falling prices of detached houses, semi-detached homes and condos for sale in Mississauga, buyers can see prices typically stay stable through the years.

Why Move to Amazing Mississauga?

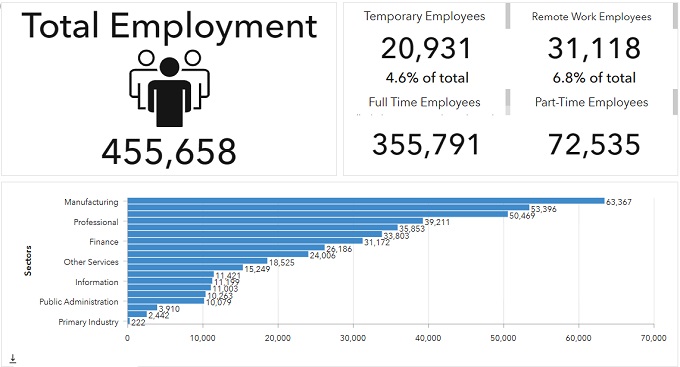

Mississauga enjoys close proximity to Toronto, Toronto International Airport and the major highways of 401, 407, and the QEW. Employment is strong, and Mississauga has had the lowest taxes of any town or city within the GTA for many years.

Mississauga also possesses a lot of land for development. There is brownfield land for residential and commercial development and there are older buildings and properties that could be developed. Mississauga has the best attitude toward business development. Lower startup costs and high market access, makes it ideal for immigrant investors wanting break into the Canadian and US market.

If you’re a buyer with an eye on launching a business or moving here to the Toronto area to work, Mississauga may be the most intelligent choice. The city has enjoyed phenomenal growth of late, which is most noticeable in Mississauga’s urban core area near Hurontario St. and Burnhamthorpe Rd which is located in the more south eastern area of Mississauga. The beautiful scenery of Lake Ontario and the night life of Toronto are very close by.

It’s difficult to have a successful economy and community unless your real estate sector is thriving and enabling the development of homes and businesses. Mississauga grows because of the pro-business sentiment here. If home and condos prices are lower in Mississauga, it’s because there’s more land to use.

Communities such as Oakville, Milton, and most districts in Toronto have less usable land and that drives up prices. Home prices are still very reasonable in this city. If you’re a first time buyer who doesn’t mind a little commute to work, Mississauga gives you a chance to own a home or condo for hundreds of thousands of dollars less than other communities in the GTA.

There is a shortage of homes for sale in Mississauga. To buy one, you’ll need a creative Realtor who knows how to get homeowners to look ahead and let go of their house. Today, you need a good Realtor to find a home. Contact me and I can connect you with someone who is competent and whom you can trust.

Housing Starts in Mississauga

Mississauga can make your dreams of home ownership in Canada come true. The employment stats and modern lifestyle, great schools, and good transportation options offer everything you need to launch and grow your family. Living here gives you a better chance at qualifiying for a home mortgage and having a financially sustainable lifestyle. Compare this to other communities with high home prices and higher unemployment, and you’ll note how Mississauga is a less risky option.

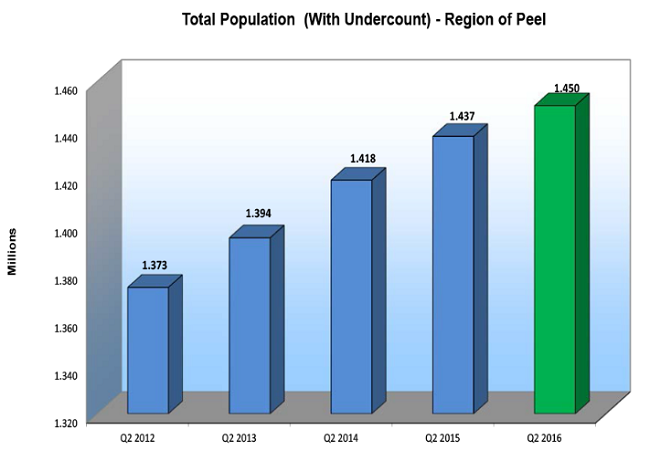

Mississauga is the largest city in the region of Peel. Other municipalities in Peel, including Brampton and Caledon have plenty of room to grow, and this may be why prices are lower here.

However, this graphic below shows that construction starts of new single detached homes in Mississauga have plummeted from 2015. This will put upward pressure on prices of homes for sale on the resale market (Mississauga mls). Peel Region reports that these 478 home construction starts is the lowest in many years.

Will Population and Employment growth In Peel Region support Real Estate Prices

Screen Capture courtesy of Peelregion.ca

Screen Capture courtesy of Peelregion.ca

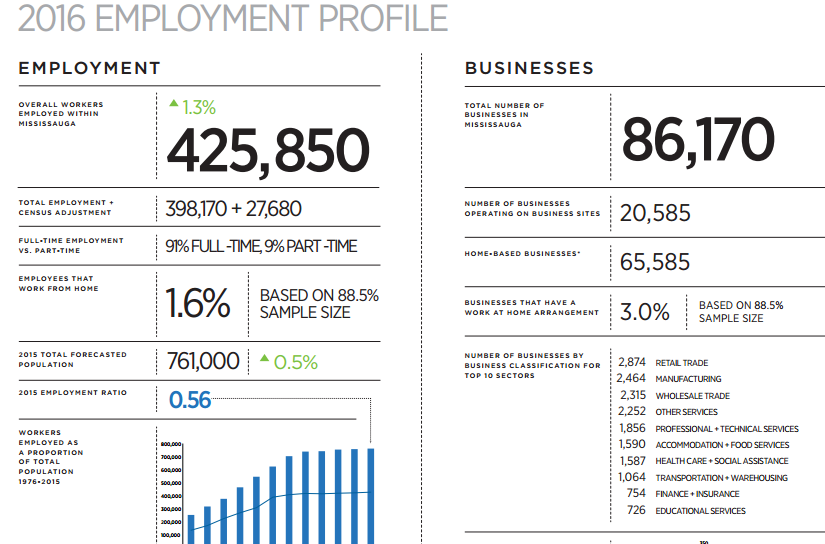

This graphic from Mississauga.ca/data has one significant stat: that 93% of employed people here are in full time jobs.

Apartment Construction Expected to Grow

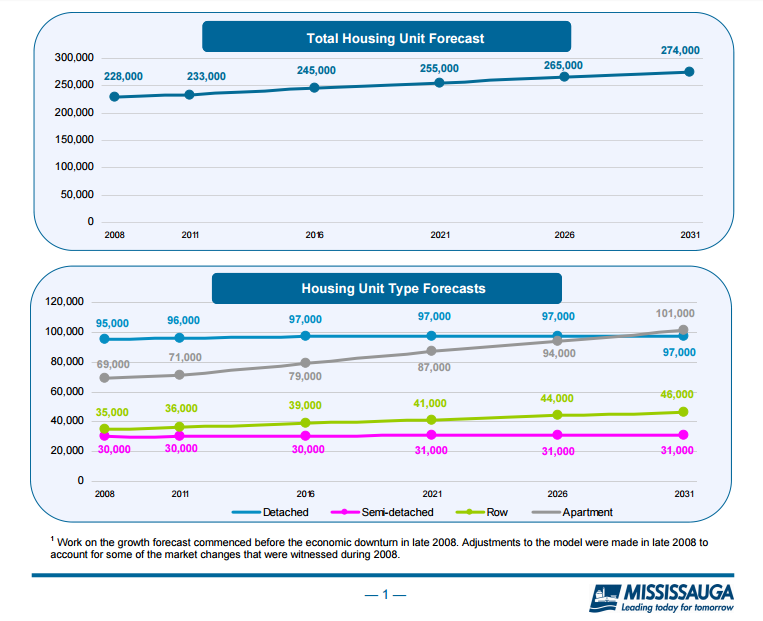

This stat from the City of Mississauga’s (Mississauga Growth Forecast Housing 2008 – 2031 report), suggests they expect a huge growth in multi-unit apartment buildings to begin in 2016. The current forecast shows less growth in apartment construction. However, with housing availability at a premium, perhaps condo and apartment units will grow in number to support the population.

| Community | Sales Volume 2nd Quarter 2016 | Avg Price | Sales Volume 2nd Quarter 2015 | Avg Price | Year t Year Increase % |

| Mississauga Total | 3880 | $648,902 | 3670 | $564,898.00 | 14.87% |

| Lisgar | 191 | $684,256 | 164 | $570,554.00 | 19.93% |

| Churchill Meadows | 311 | $696,378 | 308 | $601,684.00 | 15.74% |

| Western Business Park | 0 | ||||

| Meadowvale | 258 | $529,524 | 220 | $445,083.00 | 18.97% |

| Meadowvale Business Park | 0 | ||||

| Streetsville | 81 | $716,694 | 56 | $544,594.00 | 31.60% |

| Central Erin Mills | 158 | $780,193 | 193 | $654,322.00 | 19.24% |

| Erin Mills | 245 | $683,655 | 223 | $623,228.00 | 9.70% |

| Sheridan Park | 0 | 1 | |||

| Sheridan | 71 | $943,030 | 66 | $939,655.00 | 0.36% |

| Southdown | 0 | ||||

| Clarkson | 139 | $798,627 | 171 | $633,160.00 | 26.13% |

| Lorne Park | 111 | $1,444,628 | 90 | $1,236,229.00 | 16.86% |

| Meadowvale Village | 165 | $755,922 | 154 | $652,162.00 | 15.91% |

| East Credit | 268 | $767,183 | 245 | $664,031.00 | 15.53% |

| Creditview | 38 | $656,815 | 46 | $569,183.00 | 15.40% |

| Mavis-Erindale | 3 | $1,005,833 | 0 | ||

| Erindale | 128 | $635,394 | 100 | $585,369.00 | 8.55% |

| Gateway | 0 | ||||

| Hurontario | 308 | $539,771 | 298 | $472,899.00 | 14.14% |

| City Centre | 449 | $323,932 | 398 | $297,012.00 | 9.06% |

| Fairview | 30 | $517,496 | 40 | $592,248.00 | -12.62% |

| Mississauga Valleys | 137 | $415,141 | 122 | $373,867.00 | 11.04% |

| Cooksville | 171 | $486,128 | 158 | $454,092.00 | 7.05% |

| Mineola | 66 | $1,321,843 | 53 | $1,210,223.00 | 9.22% |

| Port Credit | 47 | $900,310 | 55 | $705,185.00 | 27.67% |

| Malton | 144 | $485,141 | 151 | $424,426.00 | 14.31% |

| Northeast | 1 | 2 | |||

| Airport Corporate | 0 | ||||

| Rathwood | 94 | $661,293 | 88 | $559,067.00 | 18.29% |

| Applewood | 148 | $579,812 | 132 | $494,232.00 | 17.32% |

| Dixie | 0 | 5 | $495,580.00 | ||

| Lakeview | 118 | $782,080 | 131 | $654,881.00 | 19.42% |

This report on the Mississauga Real Estate outlook is updated monthly. Please Bookmark this page and return. See more on the Toronto housing market.

5 Year Real Estate Forecast | Toronto Housing Market Forecast | Vancouver Housing Market Forecast | Calgary Housing Market Forecast | 3 to 6 month Stock Market | Florida Housing Market | California Housing Market | Stock Market Tomorrow | Housing Market | Will the Stock Market Crash? | 5 Year Stock Forecast | Los Angeles Housing Market | Real Estate Marketing for Los Angeles Agents | Real Estate Marketing Packages