Auto Insurance News Report

Welcome to the latest edition of the Auto Insurance News Report. Aside from finding the lowest auto insurance quote, you can get up to speed on what’s going on the insurance industry.

Bold Move in California – Banning Gender Bias in Car Insurance

The New York Times has reported that California became only the 6th state to ban discrimination in insurance rates based on gender (in a related story, gender change surgery clinics have reported a drop-off in surgeries :)

The report suggests rates would only decline by 5% for teen boys, which may suggest the insurance companies have found a way around the issue to keep profits in tact.

California Still Light on Texting and Driving

California offers demerit points to $50 fines to drivers caught texting and driving. Seems a light penalty compared to other jurisdictions in North America?

BC’s ICBC Asking for 6.3% Increase for Auto Insurance rates for BC Drivers

ICBC recently requested an increase in car insurance rates with the BC utilities commission. ICBC has been in severe financial difficulty and just posted a 860 million dollar loss for 2018. One would wonder how any business entity could continue after such catastrophic losses. The new rates translate to $60 more per year for BC drivers. ICBC cites fast growing injury claims for the increase.

IBC president says auto insurance in Canada has a long way to get it right.

Rod Forgeron said “Combined loss ratio increased – from just over 99% in 2017 to 102%. He says even insurance companies are finding profits falling. It might be time to pinpoint where these crippling costs are coming from!

Highest auto rates are in Los Angeles and San Francisco

Los Angeles and San Francisco county named as the two most expensive counties in California for auto insurance rates. Drivers in LA and SF pay an average 34% more for auto insurance. Santa Barbara cited as the cheapest

Honest Communications with Insured Customers Pays Off — Survey Says

According to the J.D. Power 2018 Canadian Auto Insurance Satisfaction Study The Co-operators (Atlantic and Alberta) and The Personal (Quebec and Ontario) insurance companies had the highest customer satisfaction rating.

“Satisfaction among customers who were not notified of a premium increase is 70 points lower than among customers who were notified” — JD Powers.

Satisfaction was measured across five factors (in order of importance): non-claim interaction; price; policy offerings; billing and payment; and claims across 4 Canadian regions. There were almost 9,000 insurance policy holders polled.

Key findings from their survey include:

- customers prefer online channels

- first time resolution of customers issues

- insurance companies that fail or mess up do have a chance to turn the situation around with the insured

Co-operators Insurance ranked best in satisfaction for the 5th straight year. Co-operators and Intact were ranked highest in Atlantic Canada. In Quebec the province insurance department ranked highest.

Auto Insurance Customers Seem to Like Tech Devices and Software

A Survey by Belaire Direct found that Canadians are willing to adopt auto insurance technology. Three quarters of Canadians said they were okay about using an an app that monitors their driving habits in exchange for a “personalized car insurance premium.” They also discovered that many Canadians aren’t driving as much. 32% drive less than 10 kilometres per year, ostensibly to save money, reduce carbon emissions, and reduce their commute.

CAA Announced Its Pay as You Go Insurance Program

CAA announced their Pay as You Go Auto insurance plan. With these policies, drivers would pay per every 1,000 kilometers they drive. The produce is targeted at drivers who drive less than 9k per year. CAA says drivers could save up to 30% with pay as you go insurance.

Auto Insurance Rates in Ontario will Rise Because of Marijuana Use

Rates are said to poised to rise in Ontario due to recent legalization of marijuana. The forecast comes from data on the state of Colorado which had legalized marijuana. Car insurance in Colorado has risen more than 54% during the 2011 to 2017 period.

“When it comes to auto insurance, crash rates have increased in areas where cannabis has been legalized in the U.S., and Canadian auto insurance companies are aware of this.” said Alyssa Furtado of Ratehub. They report an alarming number of pot users drive their vehicles shortly afterward.

Florida Drivers Got Dinged for Car Insurance in 2018

Auto insurance rates are up across the US by about 8.5% this year, after a 7.5% rate increase last year. That is well beyond rates of inflation, which you think would be outrageous to politicians.

It may be worst in South Florida. A Sun Sentinel report says insurance experts are blaming the rate hikes on increased risks on the roads:

- Too many drivers are staring at their smartphones from behind the wheel

- Cheap gas is inviting people to drive more

- Strong economy is putting more vehicles on the roads

The report showed that accident rates were up 15% during 2014 to 2016, while population growth was less. Crashes with fatalities rose 27%. Vehicle crashes increased in number to an eye opening 395,785 in 2016. Clearly, there is an issue with drivers.

The report says Florida has the 5th highest rates in the country for an average yearly premium of $1427. The highest increases in insurance rates were charged by Safeco Insurance, Nationwide Insurance and the Hartford Insurance Company. Hialeah, Miami and Tampa were rated as having the highest car insurance rates.

Previous Auto Insurance News:

ICBC Desperate for Cash to Stave off Bankruptcy, new ideas include caps on claim payouts, street cameras, and almost impossible requirements to gain a driver’s policy discount. New NDP government has its ands full with throttling Alberta oil and is clamouring to deal with ICBC $1.3 Billion deficit for 2018.

The government’s ICBC executives are trying to resolve their business crisis with ineffectual fixes. They believe raising car insurance premiums, capping accident claims, considering driving experience in driver ratings, raising premiums for drivers with minors and serious convictions, giving discounts for low-risk drivers and by revamping ICBCs antiquated driver rating system, they can avoid privatizing the auto insurance industry.

BC drivers and tax payers might still be wondering how this will resolve a $1.35 billion dollar problem each and every year ahead.

Vancouver’s experimentation with government run auto insurance is revealing what it should have known before. ICBC has run into severe financial difficulties and is now looking at any revenue sources to keep it alive.

Vancouver BC Canada to Have the Most Expensive Car Insurance

The Canadian Taxpayers Federation is charging that the ICBC is using its monopoly to drive Vancouver auto insurance rates higher. That would give Vancouver auto rates the distinction of being the highest in Canada, above the car insurance rates Toronto drivers pay.

That would underscore the importance of shopping for a better auto insurance quote and comparing value.

ICBC’s own poll of BC drivers suggested they want more competition in the auto insurance marketplace. 89% of respondents believe shopping around for insurance would save significantly on their auto insurance costs. Last year, ICBC stopped providing insurance coverage for luxury cars.

Auto Insurance in Toronto Continues to Rise

A recent report called Fair Benefits Fairly Delivered: A Review of the Auto Insurance System in Ontario, revealed that Ontario drivers paid an average annual insurance premium in 2015 of $1,458 per vehicle, nearly 57%higher than the national average of $930. A report in the Toronto Star suggest that high premiums are going to experts and lawyers and not to those injured in auto accidents. That was not the intent of the no fault insurance program, but it looks like the rich are benefiting from it, rather than ordinary Ontario drivers.

High Tech Cars Being Blamed for High Auto Insurance

A new report from suggests that new advanced technology used in today’s cars is actually driving up insurance rates. In fact they’re blaming the 8% increase in auto insurance rates on the new tech in vehicles, increase in cars on the road, and higher medical bills.

Consumers not using Latest Technology to File Claims

Although many insurance companies have sunk a lot of money into apps and online connectivity, car owners are not ready to use them it seems. JD Power and Associates just reported that only 9% of claimants will file online. Overall satisfaction with their digital first notice of loss (FNOL) online service dropped 16%.

It seems insured parties prefer a quick phone call to report an accident. JD Power found that claims service was the most important benefit. Customer satisfaction with digital appraisal apps improved by 26 points among Gen Y consumers, but declined by 16 points among Pre-Boomers.

Will Tesla Electric Vehicles Cost More to Insure?

If you’re one of the 300,000 people who put down $70,000 each for a Tesla Model 3 this year, you may want to plan ahead to pay your auto insurance too. If the price of the car plus finding a recharging station aren’t concerning you, the cost of your insurance may.

A report in the Huffington Post suggest insurance rates for electric cars is about 6 to 8% more expensive than a comparable gas powered car. This is despite the good crash testing ratings of the Tesla models. If you’re looking to know more about car insurance for Tesla vehicles, visit ratelab’s excellent coverage.

From the Denver Post:

Tesla’s U.S. sales of its Model S sedan jumped 59% over the same quarter last year, increasing its already sizable lead among large luxury cars, according to internal third-quarter sales numbers — which Tesla usually keeps confidential — and competitor data compiled by the company. Tesla says it’s now responsible for almost a third of all sales in the segment. Its nearest competitors are the newly updated BMW 7-Series and the Mercedes-Benz S-Class.

UK Drivers Paying More for Electric Vehicle Insurance

A new report from the Actuary says UK drivers are paying 45% more for ecar insurance. Despite government mandated controls of gas powered vehilce and a push to clean air, it looks like the cost of repairing electric vehicles may be weighing on cheaper auto rates.

Growth of Electric Vehicle Sales Faster Than Anyone Expected

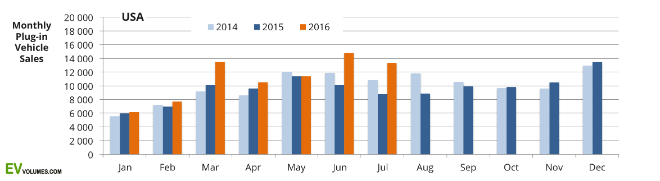

According to EV Volumes, sales of electric vehicles are rising quickly. They found that total plug-in vehicle sales in June increased a 46 % over last June. The growth is reported to be 10 times that of traditional gas powered vehicles. The EV growth seems to be attributable to a preference for them in China and the fact new batteries are cheaper and more powerful. The trend continues.

Around 312,000 plug-in electric cars were sold during the first half of 2016

Tesla Motors is preparing to revolutionize the automobile and fuel industries. Learn more about Tesla.

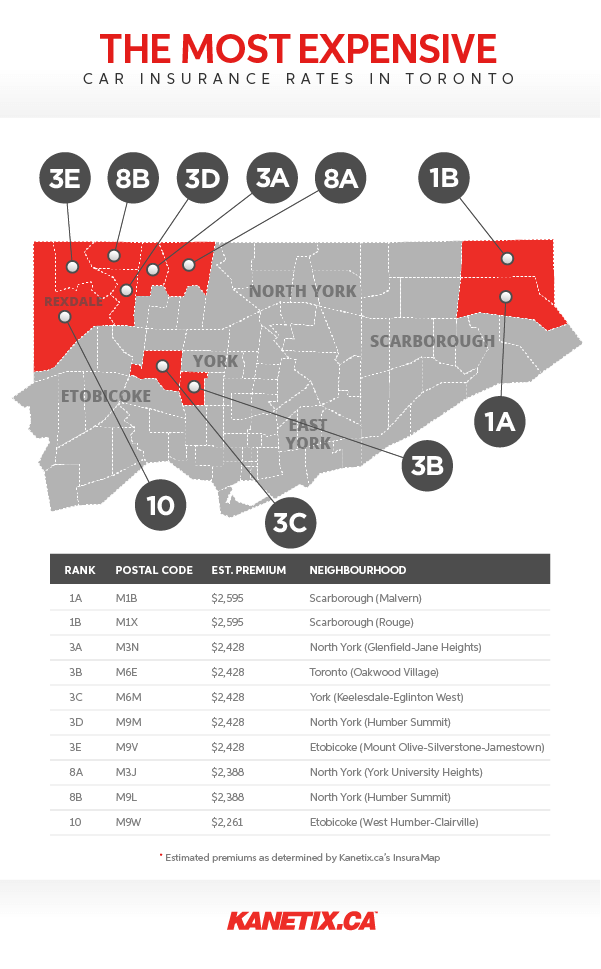

Higher Insurance Rates in Some Toronto Neighbourhoods

Canadian insurance website Kanetix, recently published a report that shows that drivers in certain Toronto neighbourhoods are paying more for insurance. The graphic below shows the neighbourhoods Kanetix determined to have higher auto insurance rates. The report suggests that the presence of hazardous intersections may be the source of risk that results in the higher premiums. They also reported that insurance rates in Toronto may be 30% or $449 higher than the provincial average. The difference in premiums from the least expensive to the most expensive was $945 per year.

For certain types of drivers and certain types of vehicles, we’d have to think the differences could be much wider. The risk factors would magnify each other and results in a higher insurance quote for certain types of drivers in some neighbourhoods, yet generate very low insurance quotes for others.

A report in the Toronto Star, citing the Kanetix study says claims are more frequent in these areas of Toronto and the payouts are higher. They cited poorer neighbourhoods as having the biggest increases. In one case, a driver said his premiums rose by $1000 when he moved from Ajax to Toronto to eliminate his commute. In the report, Pete Karageorgos, director of consumer and industry relations of Ontario with the Insurance Bureau of Canada says that shopping for insurance is the key to keeping rates under control.

The takeaway from this recent news is that insurance companies may be making major alterations to how they underwrite insurance in order to grow their profit margin. Good too stay aware or get caught in their trap!

California Drivers are the Worst

If you’re a driver in California, you might be feeling badly about this ABC news report that you’re the worst car and truck drivers in the country! They quoted a study by QuoteWizard which looked at traffic citations, incidents of people driving under the influence, along with the number of car crashes into consideration. It seems California has more of all that and are probably paying for it when they buy a new auto insurance policy.

“California is number seven for accidents, number nine for speeding, and number five for citations. Even worse, its number two for DUIs,” the study reads.

Rising Speeds Have Results in 33,000 Additional Fatalities

This fascinating new report on CBSnews.com shows how accidents, fatalities and general road safety vary right across the US. We all know certain highways areas are fraught with risk, but the report shows how tolerance for bad behavior could be behind the rates of driving mayhem in certain states and cities. While Montana and Arkansas had most fatalities, with Georgia the fastest growing, New York and California actually had the fewest fatalities per 100,000 population.

Toyota and Honda top Safest Cars List for 2017

38 models were awarded the Insurance Institute for Highway Safety’s designation of Top Safety Pick. Toyota and Honda lead the list of manufacturers safest vehicles. The reported that one major design flaw in vehicles was headlights. These are the to 6 cars/SUVs that IIHS believed are the best of the bunch in 2017:

- Acura MDX

- Acura RDX

- Audi A4

- Audi Q5

- Buick Envision

- Chevrolet Volt

Only 82 vehicles qualified for the 2017 honors list.