CAD USD Exchange US Dollar Forecast – Foreign Currency Exchange Rates

USD CAD Exchange Rate Predictions

The US dollar is trending much higher against a basket of global currencies. Against the Canadian dollar, it is soaring.

The US dollar is trending much higher against a basket of global currencies. Against the Canadian dollar, it is soaring.

The USD CAD exchange rate is now at $1.43 USD. The key factor driving the CAD lower is lower oil prices, which today are falling below $26 a barrel.

The US stock markets are falling again today, despite the new stimulus package offered by President Trump for the US. Europe and other nations are enacting their own stimulus efforts to get their economies through the Corona Virus Pandemic period. Canada has just reported a fast rising number of new Covid 19 infections which will not delight investors.

Toronto’s stock market, the S&P/TSX Composite Index dropped 10% to its lowest level since February 2016. And it’s drop from the Feb 20 peak is now 31%. There is little to support the CAD from further drops.

Canada’s dollar is highly influenced by the price of Oil, which is trending downward quickly. The Canadian government draws significant tax revenue from Alberta’s oil industry and this could leave the Federal government with a crisis similar to Alberta’s ailing economy.

Oil Prices Falling Rapidly

The OPEC cartel has indicated it will increase oil production which will deflate oil price predictions. Gold and silver have not advanced as expected, and other commodities are suffering price decreases due to much lower manufacturing activities.

FXEmpire’s analyst says the CAD has broken through a significant psychological barrier which could leave it to plummet further against the surging $USD. The US dollar is where global investors are parking their wealth, not Gold or other precious metals.

The forecast for the US Dollar vs Canadian Dollar is creating sell orders on the loonie. The Canadian dollar outlook has been hampered by western oil transport issues, high Canadian taxes, and the poorer NAFTA agreement for Canada. The potential for the Canadian dollar to fall has been high and with the Corona Virus, it finally has.

Economic Weakness & Government Dampening Measures

Economic Weakness & Government Dampening Measures

The Canadian economic outlook was positive in 2019 but not enough to stop the loonie from losses.

The housing market was supporting the economy yet it has fallen into what some suggest might be a Toronto housing crash in 2020.

Are you a Canadian realtor or US property investor looking to take advantage of opportunities in Canada? There are excellent commissions to be earned in promoting Canadian investment property. Land is and will be, a bargain for Americans in 2020. Check out the buyers guide on how to buy Canadian property.

When buying Canadian property, ensure you use a forex broker to get better rates. Have a look at current foreign exchange rates for the USD, CAD, Euro, Yen, Yuan, BPD, and Peso. Don’t just accept bank exchange rates if they’re skimming up to 9% on the conversion. Shop around and keep an eye open for forex companies with better conversion rates.

In this post, we explore the forecast outlook for the CAD vs USD, the macroeconomic and business factors drive it, and what opportunities American’s can enjoy buying real estate in Canada. The forecast for the US housing market is rosy, but the potential ROI from Canadian real estate is an eye opener in 2020.

In this post, we explore the forecast outlook for the CAD vs USD, the macroeconomic and business factors drive it, and what opportunities American’s can enjoy buying real estate in Canada. The forecast for the US housing market is rosy, but the potential ROI from Canadian real estate is an eye opener in 2020.

Buy American? Wait a Minute, Canada is Really Cheap right now!

One obvious opportunity is the increasing attractiveness and affordability of Canadian real estate for Americans. The rising economic power of US investors means there are a huge pool of buyers with money to spend on homes, condos and land. Sellers will have to compete to be heard in the clamor for American buyers, but a good measure of buyers will be from the US in 2018.

By June 2018, US property buyers may enjoy a 50% premium on their money based on a falling loonie and rising real estate values which have recently plummeted. There’s no market crash here, but prices have taken a big downtown in Toronto and Vancouver.

Is the US Dollar Rising Against Most Other Currencies?

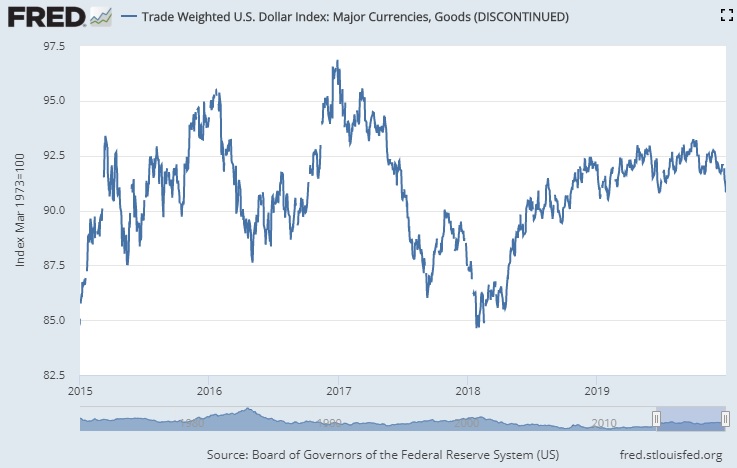

This chart from fred.stlouisfed.org shows the US dollar is rising. The exchange rate with the loonie is pronounced with it chasing equilibrium. It wasn’t long ago that 1 USD equalled 1 CAD. Forex brokers and FX traders will be selling their buying Canadian dollars in anticipation of the rise.

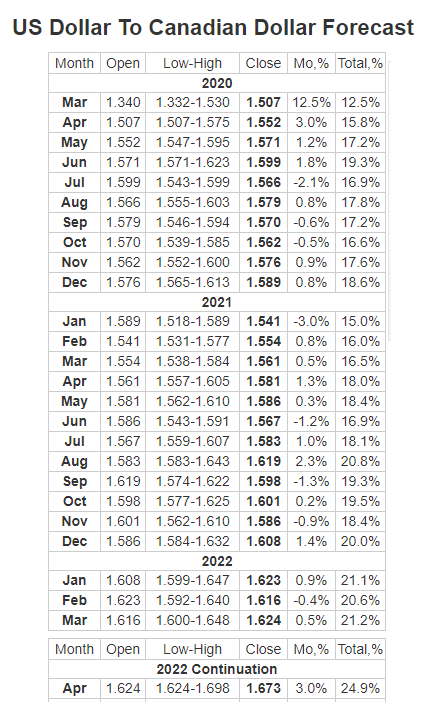

Longforecast.com is offering its prediction of a more moderate yet lasting fall for the loonie. This chart shows the US dollar will depreciate by 7% in the next 11 months.

Whereas this data below forecasts the currency to remain where it is. It was only 1 year ago that it traded at $1.37 CAD. Forex forecast experts and fx brokers might consider the Loonie one of the most volatile currencies of the G7

USD vs CAD Exchange Rate

The full impact of President Trump’s policies are difficult to foresee, however many experts believe the signals are clear about the US Dollar forecast. It is going to rise against all currencies including the Canadian dollar.

What Macroeconomic factors are driving the USD/CAD Rate?

- powerful US economic output and forecast

- investors see the USD as a safe haven in troubled times

- US government enacting a $trillion stimulus plan

- lower interest rates will keep CAD same or will be reduced in order to maintain business competitiveness

- cheap oil and gasoline giving American consumers a break

- rising trade barriers and border taxes will reduce Canadian trade advantage thus discouraging multinational corporations who can’t make winfall profits anymore or move their wealth fast to avoid taxes

- rising US productivity, jobs, startups, and speculation will pull investment money into the US thus raising demand on US dollar

- rising consumer spending power will raise US inflation

Canadian companies will only look good on the basis of their cost advantage selling to the US. If negotiations don’t go favorably for Canada, we could see a Vancouver and Toronto housing crash. That’s a long shot, but risk is risk. We won’t see a crash in US housing markets.

Share this post on Facebook, Twitter, or Linkedin. It’s good to share!!

3 month Stock Market Outlook | Stock Market Tomorrow | Housing Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | S&P Predictions | Stocks Next Week | Stock Prediction